Here’s a few of the articles I’ve had published with Middle East Policy:

Wiley Online Library (12 September, 2020). Retrieved, onlinelibrary.wiley.com/journal/14754967

Category: Arabian Gulf

Oil-rich Saudi Arabia is turning to sunshine

If Saudi Arabia can reduce the amount of oil it burns for electricity, it will have more of its biggest source of revenue for export.

by Alexandra Zavis | May 31, 2018

Ever since a team of American geologists discovered oil in the Saudi Arabian desert 80 years ago, the kingdom’s vast crude reserves, estimated at one-fifth of the world’s total, have been the primary engine of its economic growth — and a major source of its international clout.

During a recent swing across the United States, Crown Prince Mohammed bin Salman signed a $200-billion deal with Japan’s SoftBank conglomerate to build solar parks in his kingdom that can produce 200 gigawatts of electricity by 2030. That is a staggering figure, equivalent to roughly half the world’s entire solar capacity at the end of 2017.

Although the agreement was not binding, it signaled the intention of the world’s largest oil exporter to not only diversify its energy mix but also become a force in the growing market for clean power.

Whether Saudi Arabia can achieve its goals remains to be seen. Investors, though, see plenty of potential. “The kingdom has great sunshine, great size of available land and great engineers, great neighbors, but most importantly, the best and greatest vision,” SoftBank’s chief executive, Masayoshi Son, said when he announced the deal in New York at the end of March.

But Saudi leaders have announced ambitious plans to ramp up solar production before, only to back away. By the end of last year, the country had just 50 megawatts of photovoltaic systems installed — less than Kyrgyzstan or the state of Louisiana. The largest installation, a 10-megawatt array, sits atop carports at the state oil giant, Saudi Aramco. It produces enough electricity to power a nearby office tower.

Still, market analysts say there are reasons to take the Saudis seriously this time. Three years of low oil prices have produced yawning budget deficits, hurting the government’s ability to provide the public sector jobs and benefits — including cheap gas and electricity — to which its citizens have grown accustomed. Although recent subsidy cuts and the imposition of new taxes and fees have helped reduce the budget gap, growth has slowed dramatically, and unemployment remains a concern.

The push for more renewable energy is part of a broad strategy led by the country’s 32-year-old crown prince to wean the economy off oil exports and create meaningful jobs for the hundreds of thousands of young people entering the workforce each year. The government has also been investing in other sectors, including entertainment and technology, and has announced plans to sell a 5% stake in Aramco to create the world’s largest sovereign wealth fund.

“Oil is not going to be with us forever, and we need to produce other engines of growth,” said Amin Shibani, office director for the minister of energy, industry and mineral resources, Khalid Falih.

Moreover, Shibani said, the demand for electricity has surged by about 7% a year over the past decade, the product of a growing population, a construction boom and heavily subsidized prices that in effect encouraged people to indulge in comforts such as air conditioning. The country’s growing cities and industries are also heavily reliant on desalination for their water supplies, an energy-draining process.

Almost all of that electricity is currently produced by burning oil and natural gas. But rapid declines in the cost of solar and wind generation have made renewable energy an increasingly attractive alternative, even for one of the world’s biggest producers of fossil fuels. “It’s a price thing,” said Jenny Chase, an analyst at Bloomberg New Energy Finance. “Finally the price of solar electricity has come down to the extent that it’s probably cheaper to generate from solar than from oil.”

If Saudi Arabia can reduce the amount of oil it burns for electricity, it will have more of its biggest source of revenue for export. Although consumption levels have declined since the country started slashing energy subsidies in 2016, the country is still burning about 450,000 barrels of crude a day to meet its needs, according to figures compiled by the Joint Oil Data Initiative in Riyadh. If that fuel were sold abroad, it could add about $11 billion in annual revenue, at current prices.

Saudi officials set an initial target of generating 9.5 gigawatts of renewable energy by 2023, most of it solar, with some wind as well. A new office, with staff drawn from Aramco, was set up within the Ministry of Energy, Industry and Mineral Resources in January last year to advance the process.

In February, it awarded the kingdom’s first utility-scale solar project to ACWA Power, a Saudi energy company. The 300-megawatt plant, which will be built in the Sakaka area in the north, is expected to create about 400 jobs and will generate enough electricity to power about 30,000 homes. The project was awarded through a competitive bidding process, under which companies agreed to shoulder the upfront costs, about $300 million, in return for a guarantee that the government would purchase the power they produce for 25 years. At just over 2.3 cents per kilowatt-hour of electricity, the winning bid was one of two that broke the record for the lowest price submitted at an auction.

Saudi authorities rejected the lower bid, however, raising some questions about how the selection was made. Shibani said the rival bid did not comply with all the terms set for the auction.

“We love low prices, but we cannot compromise the integrity of the process,” he said.

Concerns were also raised about a requirement that companies agree to spend 30% of their upfront costs on domestic suppliers, a figure that is expected to rise in subsequent bidding rounds. But that supply chain does not currently exist, and solar manufacturers might be reluctant to open factories in Saudi Arabia until there are more plants to supply.

Shibani, though, said there were factories already in existence that could be adapted to the purpose. He also suggested that manufacturers could use the kingdom as a base to export their products to other countries in the Middle East and Africa. “We don’t intend to intervene or force marriages between companies,” he said. “But we will try to help in terms of connecting the dots.”

The ministry’s Renewable Energy Project Development Office has announced plans to issue tenders this year for eight more renewable projects — seven solar installations and a wind farm — with a combined capacity of 4.125 gigawatts. Although there is great interest in these tenders, the memorandum of understanding reached with SoftBank has injected a degree of uncertainty into the market, said Benjamin Attia, an analyst for GTM Research. It includes plans to establish a new electricity company in Saudi Arabia that will seek to commission by 2019 two solar plants with a combined capacity of 7.2 gigawatts. No details were provided about the procurement mechanism, however. If investors think they might get a better return under the SoftBank program, they might not participate in the other tenders, Attia said.

According to an outline of the agreement provided by the Saudi Embassy in Washington, there is also discussion between the parties about manufacturing solar panels and developing battery systems to store the excess energy they produce during daylight hours, so it can be used at night. Ultimately, the embassy said, the aim is to export solar power and panels abroad.

Some analysts were skeptical about the promise to deliver 200 gigawatts of solar capacity and create 100,000 jobs by 2030. Both SoftBank and the Saudis have announced lofty targets in the past, which were later scaled back. The more modest plans outlined in the deal’s first phase, however, were generally viewed as more concrete and attainable.

“Even if just that happens, and nothing else of that 200 gigawatts gets built, that still drastically changes the trajectory of the Saudi solar market,” Attia said. “The solar industry generally has been watching the Saudi market expectantly for a long time, and now we’re finally ready to say the market is taking off.”

Private Sector Emiratisation

Giving private sector jobs the required significance; only such a dramatic image makeover can attract more UAE nationals to it

by Emilie Rutledge | May 10, 2018

The Federal Authority for Government Human Resources gave research on Emiratisation a boost by launching an annual award for scholarly work on the UAE labour market and human resources. This is a timely incentive because oil prices seem destined to remain some way off on their 2010—14 highs, and comfy government jobs are said to be a thing of the past.

Among the wining studies was one conducted by the UAE University; it was the first large-scale study to investigate the views of UAE nationals working in the private sector and polled 653 individuals. The survey included questions related to job satisfaction and also on context-specific sociocultural sentiments such as the prestige attached to a public sector job.

Indeed the UAE’s labour market’s distortions and segmentations cannot be fully understood, let alone addressed, without such issues being factored into the equation.

The research found that it was “salary and benefits” that most significantly and positively predicted the intention of Emiratis to continue working in the private sector, while “sociocultural influences” — societal attitudes on a given occupation’s prestige and status level — had the most significant negative effect and was likely to deter Emiratis from staying in the private sector.

In other words, money does still talk. However, employee satisfaction isn’t all about money, “training opportunities” and the “nature of job” also writ large. The latter finding is of importance because it implies, at the very least, that today’s graduates do see private sector occupations as more interesting and fulfilling, if compared to the more bureaucratic-style ‘classic’ public sector jobs.

However, as evidenced by the research, it continues to be the case that “classic” public sector positions continue to attract the most status and prestige. This sentiment is even more pronounced among male employees, with male respondents significantly more likely to be adversely affected by sociocultural influences (the pride or prestige attached to public sector positions) and be less happy with the nature (or “environment”) of work in the private sector.

The research has applied policy relevance. The more closely aligned like-for-like public/private sector positions become in terms of salaries, working hours and days of annual leave, the more attractive will be private sector career paths. Such alignment — most likely by way of more extensive subsidies or top-ups for nationals working in the private sector — would help redress the current notion that it is the citizens who’ve secured government jobs that have the higher status. The findings also show that internship programmes — that are now compulsory at some federal universities — are paying dividends and recommends that more interns should be placed in the private sector as about one-third of those surveyed were working for private sector companies where they had completed their internships.

Another revealing find was the fact that almost three-quarters of the sample of UAE nationals employed in the private sector currently had other members of their immediate family working in the same sector. Therefore government policy that champions those Emiratis who take up non-conventional private sector career paths will help change prevailing societal attitudes in relation to what is, and is not, considered a suitable career path for Emiratis.

The study on private sector Emiratisation by Dr Emilie Rutledge and Dr Khaled Al Kaabi recently received the Federal Authority For Government Human Resources Award for the Best Academic Research in HR. Their study is timely in that it considers this topic in an era where comfy government jobs are said to be a thing of the past.[1] In addition to this, their survey-based research—polling 653 individuals—is the first large-scale one to investigate the sentiments of UAE nationals actually working in the private sector. While basing their research on the notions of the Theory of Planned Behaviour and job satisfaction scales, they also factor in what are termed as context-specific sociocultural sentiments. They make the case that the UAE’s labour market distortions and segmentations cannot be fully understood, let alone addressed, without such issues being factored into the equation. As Dr Rutledge says, “employee satisfaction isn’t all about money, the benefits of even the nature of the work and relations with fellow workers, societal attitudes on a given occupation’s prestige and status levels also writ large.” As evidenced by their findings and analysis, it continues to be the case that ‘classic’ public sector positions continue to attract the most status and prestige. This sentiment is even more pronounced amongst the male survey participants.

Another issue that the study highlights is the difficulty face in defining exactly what constitutes the private sector. In a region who’s labour markets are characterised by being highly distorted and segmented along public/private and national/non-national employee lines, the division between public and private entities is often hard to determine. As Dr Al Kaabi explains, it was necessary for their study to include government-backed entities as quasi-private ones as this is what society considers them to be. While some labour market economists would classify these within the government sphere, in the UAE at least, many in this category are commercially-run and, “really do now manage their human resources as if they were genuine private sector operators.”

The study found that it was ‘salary and benefits’ that most significantly and positively predicted continuance intentions (β = .399, p < .001) while ‘sociocultural influences’ most significantly and negatively predicted continuance intentions (β = -.423, p < .001). In other words, money does still talk. These observations also suggest that the more closely aligned like-for-like public/private sector positions become in terms of salaries, working hours and days of annual leave, the more attractive will be the private sector career paths. The authors of this study both contend that such alignment—most likely by ay of public sector pay freezes than pay cuts—would help redress the current notion that it is the citizens who’ve secured government jobs that have the higher status. Other job satisfaction related constructs that had a significant impact on the degree to which individuals planned to continue working in the private sector were: ‘training opportunities’ were a positive factor (β = .163, p < .001) and interestingly, the ‘nature of job’ (β = .072, p .009). The latter finding is of importance because it implies, at the very least, that today’s graduates do see private sector occupations as more interesting and fulfilling (if compared to the more bureaucratic-style ‘classic’ public sector jobs).

In terms of differences between the genders, male respondents were significantly more likely to be adversely affected by sociocultural influences pride (or “prestige) and were significantly less happy with the nature (or “environment”) of work in the private sector. With regard to age, the younger the respondent, the less likely they will be to intend to continue working in the private sector. The study’s authors argue that younger members of society are significantly more influenced by sociocultural barriers and least satisfied with the professional development opportunities on offer. They suggest that this may be due to the fact that they have relatively junior positions at the given private sector organisation. With regard to education, the higher one’s qualification is the more likely it will be that they intend to remain in the private sector. This ties in with the age-related differences, it follows that within the private sector the positions that require post-graduate qualifications will not only pay more but will also have attached to them more status.

Of perhaps most note and applied policy relevance are the following observations. Firstly, no less than one-third of those surveyed were working for private sector entities that they had actually competed their internships with. This suggests that the internship programs that are now compulsory at some federal universities in the UAE are paying dividends. The second observation is that almost three-quarters of the sample (that is UAE nationals employed in the private sector) currently have other members of their immediate family working in the same sector. As Dr Rutledge says, “any government policy that champions those individuals who take up non-conventional career paths will help change prevailing societal attitudes and norms in relation to what are and are not suitable career paths.”

[1] Al Nowais, S. (2017, March 7). Sheikh Abdullah tells UAE youth to think beyond ‘comfortable’ jobs, The National. Retrieved from https://www.thenational.ae/uae/government/sheikh-abdullah-tells-uae-youth-to-think-beyond-comfortable-jobs-1.41511

Arabian Gulf Economics Blog

| i | This is the website of Dr Emilie J. Rutledge. An academic with over a decade’s worth of experience in designing, managing and delivering economics courses at both undergraduate and post-graduate levels (see: Courses). Emilie has published over a dozen peer-reviewed papers (see: Publications) and is the author of “Monetary Union in the Gulf”. Her current research interests include the Arabian Gulf’s economic diversification and labour market reform agendas. Emilie also provides academic consultancy services — specialising in the developing of interactive university-level courses — alongside analytical and research expertise focusing on the economies of the oil-rich Arabian Gulf. About ‧ Consultancy ‧ 📚 Papers  erutledge.com  Dr Emilie J. Rutledge |

Changes in the Kingdom

The world should push the crown prince to reform Saudi Arabia, not wreck it

The Economist | November 9th, 2017

In a kingdom where change comes only slowly, if at all, the drama of recent days in Saudi Arabia is astounding. Scores of princes, ministers and officials have been arrested or sacked, mostly accused of corruption. Many of those arrested are being held in the splendour of the Ritz-Carlton hotel in Riyadh. About $800bn-worth of assets may have been frozen. At the same time a missile fired from Yemen was intercepted near Riyadh, prompting Saudi Arabia to accuse Iran of an “act of war”.

Upheaval at home and threats of war abroad make a worrying mix in a country that has, hitherto, held firm amid the violent breakdown of the Middle East. The world can ill afford instability in the biggest oil exporter, the largest Arab economy and the home of Islam’s two holiest sites.

At the centre of the whirlwind stands the impetuous crown prince, Muhammad bin Salman, son of the aged King Salman. The prince has staged a palace coup—or perhaps a counter-coup against opponents seeking to block his sweeping changes (see article). Either way, at the age of just 32, he has become the most powerful man in Saudi Arabia since King Abdel-Aziz bin Saud, who founded the state. All this may be the precursor to profound reforms that the country needs. The danger is that it will just lead to another failed one-man Arab dictatorship.

Casting himself as a champion of the young, Prince Muhammad (known as MBS) understands that his country must reinvent itself to deal with the end of the oil boom, a burgeoning and indolent population, and a puritanical Wahhabi religious ideology that has been a Petri dish for jihadism. He has set out ambitious plans to harness private firms to reform the state and wean the country off oil. He has also eased some social strictures, promising to end the ban on women drivers and restraining the religious police. He speaks of returning to a “moderate Islam open to the world and all religions”.

All this is welcome. But the way the prince is going about enacting change is worrying. One reason is that his ambition too often turns to rashness. He led an Arab coalition into an unwinnable war in Yemen against the Houthis, a Shia militia, creating a humanitarian disaster. He has also sought to isolate Qatar, a gas-rich neighbour, succeeding only in wrecking the Gulf Co-operation Council and pushing Qatar towards Iran. With fewer constraints, he could become still more reckless. He is rattling the sabre at Iran over the war in Yemen, and may be challenging it in Lebanon. During a visit to Riyadh, the Saudi-backed Lebanese prime minister, Saad Hariri, announced that he would step down, and denounced interference by Iran and its client militia, Hizbullah (see article). What precisely the Saudis intend to do in Lebanon is unclear. But many worry about a return to violence in a country scarred by civil war and conflicts between Hizbullah and Israel.

Another concern is the economy. Prince Muhammad’s plan for transformation relies in part on luring foreign investors. But they will be reluctant to commit much money when someone like Alwaleed bin Talal, a prince and global investor, can be arrested on the crown prince’s say-so (see article). Last month Prince Muhammad made a pitch to foreign investors for a new high-tech city filled with robots, NEOM. The glitzy event took place in the same hotel complex that is now a prison.

A third cause for disquiet is the stability of the monarchy. Saudi rule has hitherto rested on three pillars: consensus and a balance of power across the sprawling royal family; the blessing of Wahhabi clerics; and a cradle-to-grave system of benefits for citizens. Prince Muhammad is weakening all three by concentrating power in his own hands, pushing for social freedoms, and imposing austerity and privatisation.

Much of this had to change. He could seek new legitimacy by moving towards greater debate and consultation. Instead, space for dissent is disappearing and executions are rising. The anti-corruption campaign is being carried out with little or no due process to determine who is guilty of what. Many ordinary Saudis are cheering for now. But the arrests look like Xi Jinping’s purges in China, not the rule of law. As he meets resistance and his base narrows, the crown prince may rely increasingly on the security apparatus to silence critics. That would only repeat the mistakes of republican Arab strongmen: socially quite liberal, but repressive and ultimately a failure.

Many have predicted the fall of the House of Saud, only to be proved wrong. The most likely alternative to its rule, flawed as it is, is not democracy but chaos. The country would fragment and, in the scramble for its riches, Iran would extend its power, jihadists would gain a new lease of life and foreign powers would feel compelled to intervene.

The world must fervently hope that Prince Muhammad’s good reforms succeed, while urging restraint on his bad impulses. President Donald Trump is wrong to cheer the purge on. The West should instead counsel the prince to act with caution, avoid escalation with Iran and free political life at home. Prince Muhammad may be heeding the dictum of Niccolò Machiavelli that it is better for a prince to be feared than loved. But this advice comes with a rider: he should not be hated.

Educated Emirati fathers want more for their daughters

The more educated a father is, the more likely he is to encourage his daughter to take up a high-powered career, a study suggests

by Roberta Pennington | April 23, 2017

Researchers from United Arab Emirates University are studying the influence of parents in their children’s careers. And an Emirati child with parents in the private sector is much more likely to hold similar aspirations, it says. Before Mariam Al Zaabi had finished university, her father urged her to become a self-sufficient, professional woman. “He wanted me to be as strong as the men,” said Ms Al Zaabi. “So he said, ‘you need to work and you need to go and earn your degree’.” Her experience is in line with the two main findings of the study into the influence of parents in their children’s careers, by researchers at UAE University.

Academics polled 335 female Emirati students to see what influenced their career intentions. Dr Emilie Rutledge, associate professor at the university’s College of Business and Economics, hoped the two findings could help with Emiratisation policy. “Encouraging more males to undertake tertiary education and continuing with the policy of subsidising the employment costs of nationals will pay longer-term dividends in terms of female labour force participation,” Dr Rutledge said. An unexpected finding was the lack of influence mothers had over children’s career choice. “Mothers, irrespective of their educational attainment level, had no significant influence in the career decision making process of their daughters,” said Dr Rutledge.

The survey also asked students whether they wanted to work in the public or private sectors, to which 78.5 per cent responded public. “Furthermore, 29.6 per cent strongly agreed with the statement that they would ‘wait’ for a government job, as opposed to taking a private sector job in the interim,” the study found. The respondents also said that if the prospective job were “interesting,” the employer offered maternity leave and employed women role models, it would increase women’s likelihood of entering the workforce, the study found. “The job being interesting was ranked as the most important and this was subsequently found to significantly increase the likelihood of labour market entry,” the researchers wrote. While salary was also identified as a factor, “it did not turn out to have a significant relationship” with choice of career.

Economic reform in the Gulf

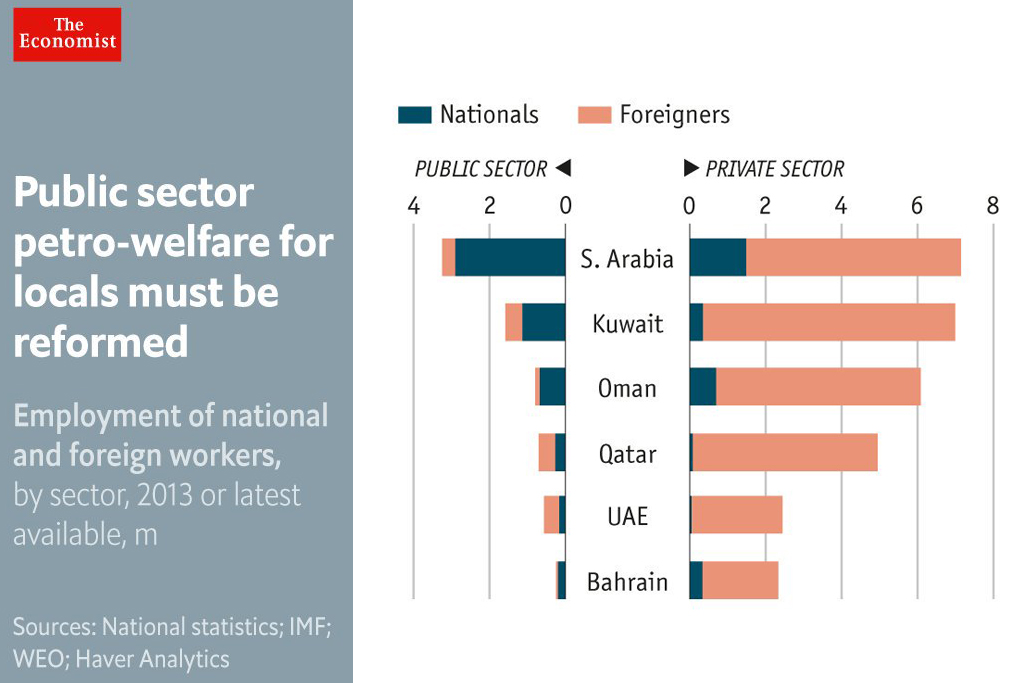

If Gulf citizens are to keep enjoying rich-world standards of living, they will increasingly have to find productive work in the private sector. That means overhauling labour markets that keep too many of the region’s citizens idle.

The Economist (2016). Time to sheikh it up. The Economist, 420(9006): 11-12.

THE people of Saudi Arabia have for decades enjoyed the munificence of their royal family: no taxes; free education and health care; subsidised water, electricity and fuel; undemanding jobs in the civil service; scholarships to study abroad; and much more. This easy life has been sustained by gushers of petrodollars and an army of foreign workers. The only thing asked of subjects is public observance of Islamic strictures and acquiescence in the absolute power of the sprawling Al Saud dynasty.

Similar arrangements hold in the other countries of the Gulf Co-operation Council (GCC), a six-member club of oil monarchies. But these compacts are breaking down. The price of oil has fallen sharply since 2014, and the number of young Gulf citizens entering the job market is growing fast. The maliks and emirs can no longer afford huge giveaways, or to pay ever more subjects to snooze in air-conditioned government offices. The monarchs know it. They say they are seeking to diversify their economies away from oil rents; they are also whittling away generous subsidies and plan a new value-added tax across the GCC.

But reforms have to go further. If Gulf citizens are to keep enjoying rich-world standards of living, they will increasingly have to find productive work in the private sector. That means overhauling labour markets that keep too many of the region’s citizens idle.

The pampering of Gulf citizens has made them expensive for firms to hire (see “Labour laws in the Gulf: From oil to toil”). By contrast, the third-class legal status of many migrant workers makes them extra-cheap (see “Migration in the Gulf: Open doors but different laws”) and puts them at the mercy of their employers. Given the choice between a hardworking foreigner and a costly local, private firms have long preferred the foreigner.

In response Gulf governments have imposed ever more stringent quotas on foreign companies to employ locals, especially in desirable white-dishdasha jobs. In Bahrain 50% of workers in banks must be Bahrainis; but only 5% of those in construction need be. (It’s awfully hot on building sites.) Quotas reduce the incentive for Gulf citizens to do a job well: why bother, when your employer has little choice but to keep you on? Firms often regard hiring locals as a sort of tax. Some pay them to stay at home.

The best policy would be to phase out quotas entirely, while also slimming the bureaucracy and making it clear that civil-service jobs are no longer a birthright. In Saudi Arabia two-thirds of citizens are employed by the state. Public-sector wages account for 12% of GDP in the Gulf and Algeria, compared with an average of 5% across emerging economies.

The way migrant labourers are treated needs to change, too. Gulf states deserve credit for letting in far more immigrants than almost all Western countries, relative to their populations. (In many cases, foreigners outnumber locals.) Migrants gain from earning far higher wages than they could back in India or Pakistan. But the coercive parts of the kafala system of sponsoring foreign workers should be dismantled. Migrant workers should not need their employers’ permission to leave the country. After a while, they should be allowed to switch jobs. Contracts should be clear and enforced by local courts. Long-term foreign workers should be able to earn permanent residence; ultimately those who wish to should have the opportunity to become citizens.

These reforms–less pampering for locals and more rights for migrants–would reshape the labour market. More locals would have to do real work. Migrants would be better treated, though inevitably fewer would be hired. Some new ideas are being tested. Bahrain is allowing firms to ignore quotas by paying a fee for each foreign worker they employ. As part of its ambitious economic agenda, Saudi Arabia is talking of issuing green cards to some migrants.

A new social contract

At a time of bloody turmoil across the Arab world, many royals fear undoing the social compact that has kept them in power. But cheap oil makes change unavoidable; doing nothing merely postpones the reckoning. Economic transformation should nudge Gulf states towards political reform. Perhaps, as their citizens are asked to do more to earn their living, they will demand that rulers do more to earn their consent.

‘Incentives needed to increase Emiratisation in private sector’

Emiratisation must address the inequity between the working conditions of the private and public sectors, according to new research.

Melanie Swan | November 16, 2015

James Christopher Ryan from the College of Business and Economics at the UAE University pointed to the discrepancy in number of holiday days, working hours and salaries.

He said standardisation between the two was the way to make the private sector more attractive to Emiratis.

“Looking at ensuring that experience and qualification requirements for comparable work are the same across sectors and aligning salaries for comparable work between sectors” should also be considered, Dr Ryan said.

He also said that more needed to be done to change the mindset of Emiratis to help them find work in the private sector.

“Historical evidence suggests Emiratisation has not been a success thus far,” he said.

“Also, my continuing interaction with UAE national students still offers clear evidence of their preference to work for public sector organisations. Once we have established a culture where the citizenry come to expect employment in government positions it can be very difficult to move successfully away from that expectation.”

The push for Emiratisation in the private sector has been slow when compared to its government counterparts, he said.

“To date Emiratisation in the government sector, that is replacing expatriate expertise with local expertise, has had success,” he said.

“However within the private sector there is not enough sustained improvement in UAE national employment to determine if we have any real success yet.”

Dr Ryan’s research was published in the Journal of Business Research.

“Successful Emiratisation will require a better balance between the conditions and rewards offered in the public and private sectors for UAE nationals. Any steps we can take to reduce the imbalance are steps in the right direction.”

Dr Emilie Rutledge, associate professor of economics at UAE University, undertook research of her own on Emiratisation that supports Dr Ryan’s observations. “In the long run, fully integrating Emiratis into the labour market is crucial for economic prosperity and social inclusion,” she said.

“Unemployment rates have been high among the Emirati population in recent years, with estimates in double digit figures, much of which is structural unemployment and can be attributed to strong public sector preferences.

“It is essential to address the paradox in pay and working hours if more Emiratis are to be willing to enter private sector employment.”

In Abu Dhabi she said only about 4 per cent of private sector employees were Emirati. Incentives were needed, such as aligning benefits and working hours, if this was to be reversed.

She said sociocultural barriers also remained an obstacle to Emiratis entering the private sector. “Several vocations in the private sector are not considered socially or culturally appropriate for nationals, and there is still a certain amount of prestige attached to attaining a public sector post.”

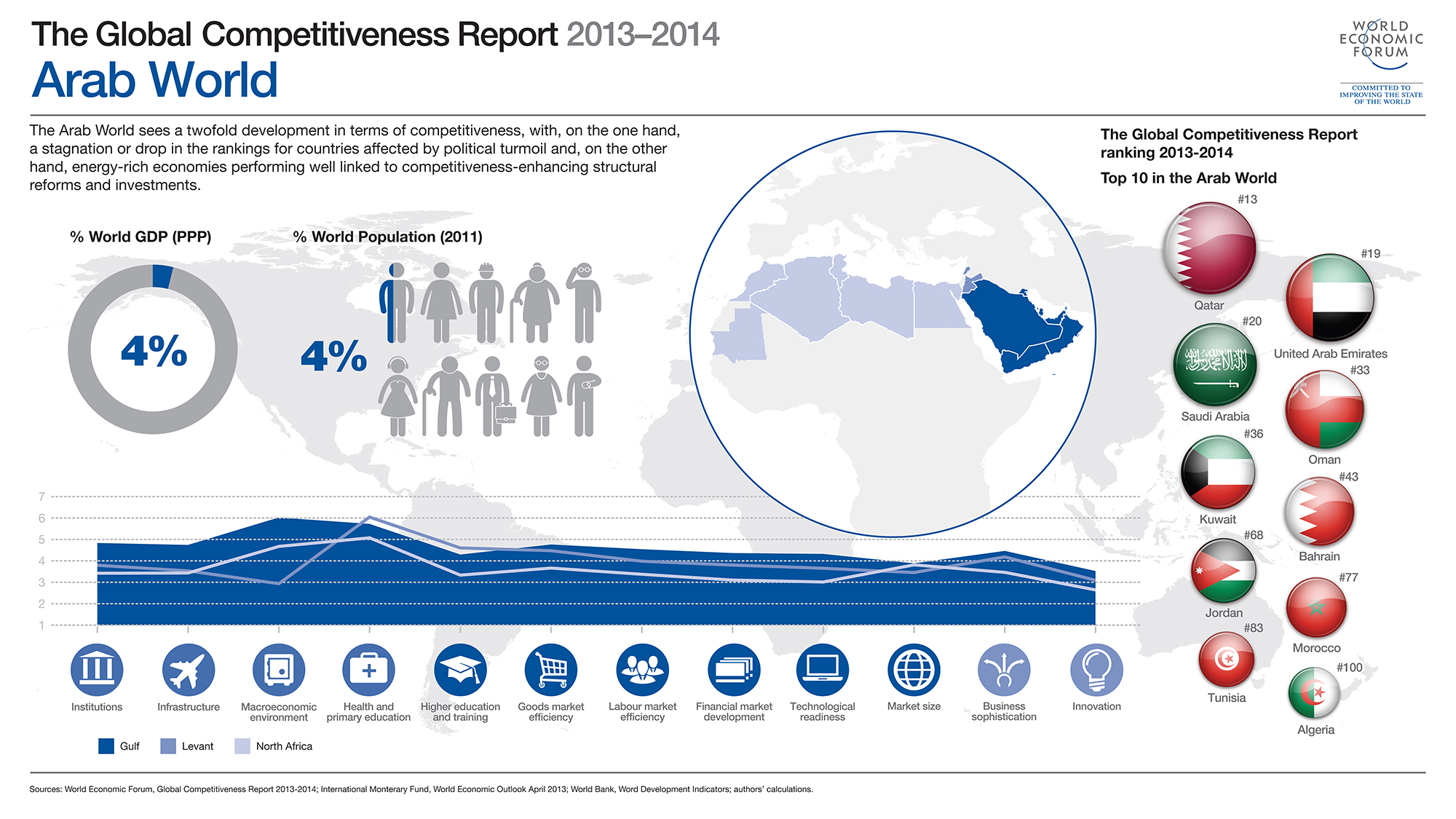

WEF global competitiveness rankings, 2013-2014

According to the World Economic Forum Qatar reaffirms once again its position as the most competitive economy in the region (13th globally) for the period 2013-2014. The country’s strong performance in terms of competitiveness rests on solid foundations made up of a high-quality institutional framework (4th), a stable macroeconomic environment (6th), and an efficient goods market (3rd). Low levels of corruption and undue influence on government decisions, high efficiency of government institutions, and strong security are the cornerstones of the country’s solid institutional framework, which provides a good basis for heightening efficiency.

Going forward, reducing the country’s vulnerability to commodity price fluctuations will require diversification into other sectors of the economy and reinforcing some areas of competitiveness. As a high-income economy, Qatar will have to continue to pay significant attention to developing into a knowledge- and innovation-driven economy. The country’s patenting activity remains low by international standards, at 60th, although some elements that could contribute to fostering innovation are in place. The government drives innovation by procuring high-technology products, universities collaborate with the private sector, and scientists and engineers are readily available. To become a truly innovative economy, Qatar will have to continue to promote a greater use of the latest technologies (31st), ensure universal primary education, and foster more openness to foreign competition—currently ranked at 30th, a ranking that reflects barriers to international trade and investment and red tape when starting a business.

The United Arab Emirates moves up in the WEF global competitiveness rankings to take second place in the MENA region at 19th globally. Higher oil prices have buoyed the budget surplus and allowed the country to reduce public debt and raise the savings rate. The country has also been aggressive at adopting technologies and in particular using ICTs, which contributes to enhancing the country’s productivity. Overall, the country’s competitiveness reflects the high quality of its infrastructure, where it ranks a solid 5th, as well as its highly efficient goods markets (4th). Strong macroeconomic stability (7th) and some positive aspects of the country’s institutions—such as strong public trust in politicians (3rd) and high government efficiency (9th)—round up the list of competitive advantages.

Going forward, putting the country on a more stable development path will require further investment to boost health and educational outcomes (49th on the health and primary education pillar). Raising the bar with respect to education will require not only measures to improve the quality of teaching and the relevance of curricula, but also measures to provide incentives for the population to attend schools at the primary and secondary levels.

Saudi Arabia remains rather stable with a small drop of two places to 20th position overall. The country has seen a number of improvements to its competitiveness in recent years that have resulted in more efficient markets and sophisticated businesses. High macroeconomic stability (4th) and strong, albeit falling, use of ICTs for productivity improvements contribute to maintaining Saudi Arabia’s strong position in the GCI. As much as the recent developments are commendable, the country faces important challenges going forward. Health and education do not meet the standards of other countries at similar income levels. Although some progress is visible in health and primary education, improvements are being made from a low level. As a result, the country continues to occupy low ranks in the health and primary education pillar (53rd). Room for improvement also remains on the higher education and training pillar (48th), where the assessment has weakened over the past year. Labor market efficiency also declines, to a low 70th position, in this edition. Reform in this area will be of great significance to Saudi Arabia given the growing number of young people who will enter the labor market over the next several years. More efficient use of talent—in particular, enabling the increasing share of educated women to work—and better education outcomes will increase in importance as global talent shortages loom on the horizon and the country attempts to diversify its economy, which will require a more skilled and educated workforce. Last but not least, although some progress has been recorded recently, the use of the latest technologies can be enhanced further (41st), especially as this is an area where Saudi Arabia continues to trail other Gulf economies.

The Middle East and North Africa

The Middle East and North African region continues to be affected by political turbulence that has impacted individual countries’ competitiveness. Economies that are significantly affected by unrest and political transformation within their own borders or those of neighboring countries tend to drop or stagnate in terms of national competitiveness. At the same time, some small, energy-rich economies in the region perform well in the rankings. This underlines the fact that, contrary to the situation found in previous energy price booms, these countries have managed to contain the effects of rising energy prices on their economies and have used the window of opportunity to embark on structural reforms and invest in competitiveness-enhancing measures.

Mineral resource abundance: Blessing or curse?

The availability of abundant natural resources, especially minerals such as oil, gas, copper, and gold, has traditionally been regarded as an important input into economic growth and higher levels of prosperity in many economies. Many oil- and gas-rich countries in the Middle East have benefited from some of the highest gross domestic product per capita in the world, for example.

However, an abundance of mineral resources does not necessarily directly equate with higher rates of sustained productivity and overall competitiveness, and thus with rising prosperity in the long term. From the 17th century, when a resource-poor Netherlands managed to flourish in sharp contrast to gold- and silver-abundant Spain, to more recent cases—such as the rapid economic development of mineral-poor newly industrialized countries of Southeast Asia, which stand in contrast to some oil-rich nations such as Venezuela—history is full of examples where mineral endowments have not proved to be a blessing for long-term economic growth. Instead, such endowments have been a curse that has held countries back from making investments to support future, long-term economic development.

In the end, the relationship between mineral abundance and levels of prosperity depends on the use that nations make of the revenues accruing from mineral exports. Those countries that use such revenues for current spending rather than on productive investments will most likely not benefit from high growth rates in the long run. In those countries, national investments are driven toward mineral extraction activities that affect the level of productivity of other activities, such as manufacturing and services. This leads to an increase in the country’s exposure to fluctuations of mineral prices in international markets. In order to avoid these negative effects, known in the academic literature as the “Dutch disease,” countries should invest their mineral revenues carefully in productive activities such as infrastructure, education, and innovation. By doing so, they will enhance their overall productivity and support a progressive diversification of their economies, becoming more resilient and ensuring more sustainable patterns of economic growth.

One crucial factor that allows countries to effectively channel mineral revenues toward productive investments is the presence of strong, transparent, and efficient institutions. The absence of corruption, along with high levels of transparency and accountability and a strong commitment to a long-term economic agenda that is based on steady productivity gains and independent from the political cycle, are necessary, if not always sufficient, conditions to ensure that natural resources support long-term growth. Chile, Norway, and the United Arab Emirates are examples of countries that are managing their mineral revenues smartly. These countries are creating national funds that avoid overheating their economies and that invest in growth enhancing activities related to education and innovation, thus supporting more diversification and preparing the ground for longer-lasting and more sustainable economic growth.

MENA: key economic issues in 2014

Economist Intelligence Unit | Middle East and North Africa: key economic issues in 2014

Since the onset of the Arab Spring in 2011 the Middle East and North Africa has in effect been a tale of the “haves” and “have nots”. The countries most affected by unrest, and in some cases war, have seen their economies stagnate. The more stable countries—which, not coincidentally, have also typically been oil-rich—have boomed on the back of fiscal stimulus and high oil prices. Yet 2014 should see the start of an unwinding of this trend, as the oil-rich “haves” take their foot off the fiscal pedal and the “have nots” begin to benefit from the upturn in the euro zone.

Nowhere has the opening of the fiscal spigots been more apparent than in the wealthy Gulf Co-operation Council (GCC). In the wake of the unrest in early 2011, all the GCC states dispensed with fiscal prudence and, buttressed by rising oil prices and production, their governments announced enormous public-sector salary and pension rises, huge new infrastructure and housing programmes, and increased subsidies. However, inevitably, such largesse has taken its toll on the public finances, and we expect all six of the GCC states to return either a narrower surplus, or, in the cases of Oman and Bahrain, wider deficits, in 2014.

GCC closes the fiscal spigots

In response, governments are being forced to act. Saudi Arabia, for example, recently announced a budget just 4% bigger than its predecessor (compared with a budgeted spending increase of 17% in 2013), and Oman’s 2014 budget projects spending just 5% up on its predecessor—a marked slowdown from the 29% spending increase announced in the 2013 budget. Similarly, for almost the first time since the collapse in oil prices in 1997‑98, several GCC governments are now publicly mulling tackling their overgenerous subsidy systems. In a blunt appraisal of the situation, the Omani oil and gas minister, Mohammed bin Hamad al‑Rumhi, told a conference in October that “subsidy is killing us” and, echoing his comments, the governor of the Central Bank of Bahrain, Rashid al‑Maraj, warned in December that the present situation is “not sustainable”. However, in reality, mindful of potentially fomenting unrest, any attempt to reform subsidies will be extremely cautious, with households almost certainly excluded, at least initially, from cuts, and industry prioritised.

Labour market policies will hinder businesses

The targeting of industries within the GCC is hardly going to help the business climate, however. Already, companies across the Gulf are being weighed down by increasingly aggressive labour market policies, which are focused on replacing foreign workers with locals. Saudi Arabia has been especially energetic in this regard, introducing a major reform to its expatriate sponsorship system, including inducements to encourage firms to hire nationals, and imposing fines on companies with more than 50% foreign workforces. Concurrently, a host of governments, including Oman, Saudi Arabia and Bahrain, have sought to encourage their wary citizens to embrace the private sector by raising the minimum wage for nationals. Overall, therefore, companies are increasingly being confronted with having to hire more, typically less well-educated and motivated locals, at a higher cost. Thus far, massive fiscal stimulus and high oil prices have shielded the GCC economies from the harmful effects of their labour policies. However, with oil prices stabilising (and forecast to decline in the coming years), the state will no longer be able to provide much of an economic prop, and thus there is a risk that the GCC’s stellar economic performance of recent years will become a thing of the past.

| Economic growth | ||||

| (% change, market exchange rate weights) | ||||

| 2011 | 2012 | 2013 | 2014 | |

| Middle East & North Africa | 2.8 | 3.7 | 2.4 | 3.6 |

| Oil exporters | 2.7 | 4.0 | 2.3 | 3.8 |

| Non-oil exporters | 3.1 | 2.8 | 2.9 | 3.1 |

| Gulf Co-operation Council | 7.6 | 5.5 | 3.9 | 4.4 |

| Algeria | 2.4 | 2.5 | 3.2 | 3.6 |

| Bahrain | 2.1 | 3.4 | 3.9 | 3.2 |

| Egypt | 1.8 | 2.2 | 2.0 | 2.2 |

| Iran | 2.7 | -5.6 | -3.0 | 1.5 |

| Iraq | 8.6 | 8.4 | 5.2 | 8.2 |

| Israel | 4.6 | 3.3 | 3.2 | 3.4 |

| Jordan | 2.6 | 2.7 | 3.2 | 3.9 |

| Kuwait | 10.2 | 8.3 | 2.3 | 2.7 |

| Lebanon | 3.0 | 1.4 | 1.3 | 2.2 |

| Libya | -61.4 | 92.1 | -2.3 | -2.7 |

| Morocco | 5.0 | 2.7 | 4.0 | 4.1 |

| Oman | 0.3 | 8.3 | 4.2 | 4.1 |

| Qatar | 13.0 | 6.2 | 5.5 | 5.0 |

| Saudi Arabia | 8.6 | 5.1 | 2.9 | 4.0 |

| Sudan | -3.8 | -4.2 | 3.0 | 2.9 |

| Syria | -3.4 | -18.8 | -19.0 | 1.8 |

| Tunisia | -2.0 | 3.6 | 2.8 | 3.0 |

| United Arab Emirates | 3.9 | 4.4 | 4.3 | 4.4 |

| Yemen | -10.5 | 0.1 | 3.8 | 5.1 |

| Source: The Economist Intelligence Unit. | ||||

Governments eschew economic reform

Meanwhile, in the rest of the region the challenge is simpler: job creation, rather than worker replacement, is top of the agenda. However, in the absence of large oil reserves or swollen sovereign wealth funds, and confronted by long-fragile fiscal positions, boosting growth will prove an uphill task. This will be exacerbated in the near term by ongoing cuts in subsidies, which have typically been focused on larger users (namely, industry), rather than households. For example, a phased 50% cut in the price subsidy for gas and electricity in Tunisia is being initially focused on only large users, and the latest electricity price increase in Jordan for major users has prompted an outcry from industrialists.

More broadly, the business climate will be further impaired by the general governmental aversion to economic reform, as populations remain wary of the capitalist models pursued by the pre-2011 generation of leaders and technocrats (which, in reality, were always undermined by corruption and nepotism). The only exception to this trend will probably be Egypt, where the current interim administration (populated predominately by technocrats and academics) is working assiduously to create a more foreign investor friendly environment following the more statist policies of the previous Muslim Brotherhood administration.

However, it will be undermined in this by the unpromising political and security outlook, which will in turn depress domestic confidence and foreign investment—a handicap that will also affect Tunisia and Lebanon, as well as hydrocarbons-rich but hyper-unstable Libya and more resource-poor Yemen. Adding to the unhelpful climate, the ongoing war in Syria will also continue to spill over its borders, strengthening the economic headwinds in Lebanon, depressing the recovery in Jordan, and potentially setting back Iraq’s recent oil-led economic bounceback.

In contrast, thus far at least, Israel has managed to remain at least economically aloof from Syria’s problems, and indeed it is well placed to benefit from the strengthening economic picture in its two primary export markets, the US and the EU. The long overdue recovery in the euro zone will also offer a rare bright spot for some of the more troubled North African states, notably Morocco, Egypt, Tunisia and Algeria, reflecting its primary importance as an export market, and as a source of remittances and tourists.

A little help from their friends

Nevertheless, in many cases such positives will be more than outweighed by the continued fallout of the Arab Spring, prompting governments in the more unstable and less resource-rich states to continue to rely heavily on outside support. The IMF play a crucial role in this regard. Jordan, for example, has had a US$2bn lending facility in place since August 2012, and the IMF also formally agreed a US$1.74bn financing programme with Tunisia in June 2013. Despite popular misgivings about the conditions attached to this lending, the Fund is likely to remain relatively flexible in its assessments, primarily reflecting the overarching desire on the part of both itself and its financers to promote stability and assist in the democratic transition.

Nevertheless, talks between the IMF and Egypt over a US$4.8bn stand-by arrangement appear to have run into the ground. Prior to the ousting of the president, Mohammed Morsi, in early July, efforts to reach a deal had been persistently hindered by the then government’s failure to follow through on promised reforms. Since July, however, it appears that talks have in effect come to a standstill, with the new interim government eschewing the option, citing the need to wait until the installation of a permanent administration.

Egypt’s reticence about the IMF stems from a trend that has been increasingly prominent over the past few years: the disbursement of financial support from the region’s oil-rich states, in particular the GCC, to regional allies. In this regard, the GCC has been especially generous to the new leadership in Egypt, with Kuwait, the UAE and Saudi Arabia offering US$13.9bn in assistance However, it remains to be seen whether Qatar, which also gave a US$500m loan to Tunisia in April 2012, will curtail its hyperactive financial assistance programme, in line with the receding of support across the region for the Muslim Brotherhood (which Qatar has proactively backed).

Money buys influence

Even without active Qatari participation, however, Saudi Arabia and its allies in the GCC will continue to work assiduously to defend the current crop of autocratic rulers. For example, Saudi Arabia, the UAE, Kuwait and—possibly—Qatar will provide further backing to Jordan and Morocco, as part of their long-term pledge in 2011 to give US$5bn to support development projects. This reflects a desire on the part of the GCC to shore up political stability, as well as maintain influence, but humanitarian concerns will also increasingly come to the fore: amid the civil war in Syria, millions of refugees have poured into neighbouring Jordan and Lebanon, threatening the authorities’ ability to cope and prompting their governments to plead for foreign assistance. (In response, Saudi Arabia pledged US$3bn to Lebanon’s army in late December.) However, given the GCC’s states hostility to the Syrian government, Syria’s leadership will instead rely on Iran, which has set up a US$4bn credit line and, unlike other parts of the region, could see a major upturn in its fortunes if a diplomatic deal can be reached over its nuclear programme.

However, again, 2014 could mark a turning point. With the GCC’s fiscal situation deteriorating rapidly and austerity in vogue, the region’s non-oil producers will increasingly be left to fend for themselves (although this may not become truly apparent until next year). With governments under-resourced and the public sector typically inefficient, the responsibility for raising living standards and boosting job growth will once again have to be shouldered by the private sector—as was much the case prior to 2011.